Michael Fitzsimmons believes the Natural Gas Glut is over. Do you?

http://seekingalpha.com/article/1947681-the-natural-gas-supply-glut...

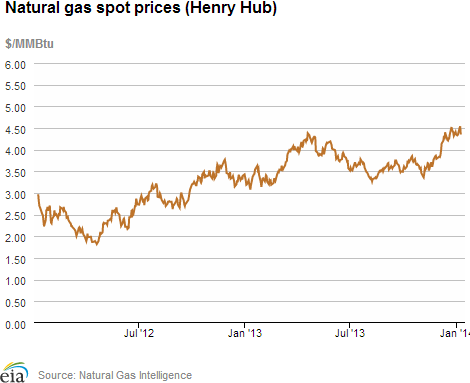

Last week the Energy Information Administration ("EIA") released its weekly natural gas storage report. In my opinion the report established what spot prices have been telling us: the natural gas supply glut is over. While this is bullish and certainly a welcome development for Exxon Mobil (XOM), the #1 producer of natural gas in the US, smaller companies like Cabot Oil & Gas (COG), Chesapeake Energy (CHK) andConocoPhillips (COP) derive a much larger percentage of revenues from domestic natural gas and will therefore see a larger impact on profits.

The sharp increase in natural gas spot prices has been widely reported. More interesting to me is the gas in storage versus the historical 5 year range - the blue line within the gray zone of the chart below. This line is clearly at the low end of the range, and indeed is on the verge of moving outside the range. Although gas in storage was on the low-end of the five-year range throughout much of 2013, it certainly did not start out the year that way. In January of 2013, just as in January of 2012, gas in storage started off the year at the very high end of the five-year range, not the low end, or possibly even below the low-end.

Tags:

Replies to This Discussion

-

Permalink Reply by adubu on January 23, 2014 at 2:20

Permalink Reply by adubu on January 23, 2014 at 2:20 -

Skip--- if you looking only at Nat Gas Price as $ amount I am sad to say that in next years to come we will see much higher $ prices on NG However it will not be true Price but severe inflated price $ due to a very weak dollar because of Federal Reserve Inflation that will occur in time. $10 gas in next 10 years+ may happen, BUT TRUE PRICE that's the Question.

My Mother said about 40 years ago we would have a lots of money--BUT-- It would not buy you anything like you thought----

remember they use to flare gas at well site--La at night look like North pole never dark and then soon after that NG was 25 cents-- WOW

-

Permalink Reply by jim weyland on January 23, 2014 at 6:32

-

i think your point is well taken. everything we in the us own is $ denominated. and we're certainly debasing the dollar's value.

so, as we debase our currency, everything dollar denominated should go up.

on certain days, one can see oil, gold and the us stock market all increase in value. lots of times one will then see that on those days, the dollar declined in value with respect to other major currencies. it's hard to wrap one's mind around the idea that the us equity markets are commodities, but, imo, taken as a whole, they surely are.

-

Permalink Reply by adubu on January 23, 2014 at 16:09

Permalink Reply by adubu on January 23, 2014 at 16:09 -

JW-- what real scary is what happen when Federal Reserve and the Liberals cause the US Dollar to no longer be the currency of the world and crude not priced in dollars.

-

Permalink Reply by tc on January 23, 2014 at 17:53

-

What currency will replace the US dollar.

The Euro? it has 10x more problems than the US.

The Yuan? is there a currency more manipulated by a central government.

The Bitcoin? is it worth 700 or 1,000 today.

As we become more energy independent, how crude is price becomes less important.

-

Permalink Reply by Paul M. Hernenko on January 24, 2014 at 1:02

Permalink Reply by Paul M. Hernenko on January 24, 2014 at 1:02 -

To ignore the inevitability of the rest of the world deciding on a currency to stabilize commerce when the dollar continues to be backed by promises from its own magician is rather foolish. Over 60% of our debt is owed to the producers of the greenback. Fiat currency backed by the greatest debtor in the history of the world, depending on the continued tolerance of all others who are increasingly working on agreements to obviate the dollar. When crude is priced by another currency and the Petrodollar of our politicians goes by the wayside, how crude is priced will become more important. Do not kid yourself. It is a Black Swan event waiting to happen.

-

Permalink Reply by essay on January 24, 2014 at 6:25

Permalink Reply by essay on January 24, 2014 at 6:25 -

instability in the world economy and financial systems thereof has had my utmost attention since before the great recession started. early on i bought into the idea of the end being just around the corner. today, i think that these sorts of changes on a macro scale can take far longer to play out than those who expect them might like.

trying to successfully predict the outcome of such a complex and mutable system is a dim prospect indeed. the other thing i'd say specifically about your post is that this particular currency war is a race to the bottom. the real thing, the ultimate tangible thing, that enforces the value of our "reserve currency" status is the u.s. military.

on the other hand, your point about a so-called black swan event is well taken. the status quo endures, until it doesn't. i.e., $#!% happens. all i'll say about that is every extra day above ground as a good one. make hay while the sun's shining etc.

-

Permalink Reply by W. Marshall Shaw on January 24, 2014 at 6:03

Permalink Reply by W. Marshall Shaw on January 24, 2014 at 6:03 -

The dollar took over as the world's reserve currency from the English pound after WW II, since the UK had bankrupted itself fighting two world wars in defense of its global empire. What has happened more frequently in the past when an important currency collapses is that people return to a commodity: gold, silver, cows.

The European Union, the Russians, the Chinese et al. are trying to devise a formula for a universally accepted currency that will transplant the dollar. Oil, as a universally traded commodity, may play at least a role in calculating that formula. I hope I don't live to see that day, but the speed with which our politicians are bankrupting the country means that I might.

-

Permalink Reply by Steve on January 22, 2014 at 5:50

-

This is what the report said:

" Natural gas prices in North America will remain in the range of $4 to $5 per thousand cubic feet for at least 20 years, thanks to shale production, according to a report from the IHS Cambridge Energy Research Associates. Even at the low end of the price range, drillers can economically produce about 900 trillion cubic feet of unconventional gas, the report found. "This means that the North American natural gas resource base can accommodate significant increases in demand without requiring a significantly higher price to elicit new supply," said Tim Gardner, vice president of IHS." Source API article today

-

Permalink Reply by W. Marshall Shaw on January 24, 2014 at 5:50

Permalink Reply by W. Marshall Shaw on January 24, 2014 at 5:50 -

I attended a conference in DC back in 1981, shortly after Reagan's election. The price of oil was $40 per barrel, and the price of gas was high and rising (I forget exactly). The consensus of the "expert" panels was that the price of oil was going to go to $100 in the near future and that the price of gas would follow in its path. We older people remember what happened shortly afterwards.

The only thing that I learned from that seminar is to never trust expert opinion as to future events, especially those that are 20 years out. Their crystal balls are usually cracked.

-

Permalink Reply by Kim Feil on January 24, 2014 at 5:35

-

keylandonahue mentioned controlling flaring ... a recent report shows end user methane losses that consumers pay for ($20 billion) but are also lost to the environment http://ln.is/bit.ly/elom8 . The overall price of NG should go up if the aging pipes downstream need to be replaced...overall fossil fuels should be phased out and replaced with renewables where feasible...consumers can and will eventually drive this as the sun and wind are free...ANGA has a solar/NG installation in Florida...here is their video... http://anga.us/media-room/videos/web-videos/florida-power-and-light...

-

Permalink Reply by 1kw6x71km1v37 on January 24, 2014 at 6:22

-

The European Union, Russia and China are all in deep economic doo-doo of their own making. The idea they could come up with a stable reserve currency to replace the dollar is laughable.

-

Permalink Reply by W. Marshall Shaw on January 24, 2014 at 6:55

Permalink Reply by W. Marshall Shaw on January 24, 2014 at 6:55 -

The EU, Russia and China are full of industrious, intelligent and highly educated people. They realize that the acceptance of the US dollar as the world's reserve currency has been deeply damaging to their economies. All of the "Q" things that the Fed has been doing is depreciating the dollar even more aggressively.

The Russians and the Chinese have made a remarkable recovery, in fits and starts, from the deep hole where their Marxist rulers had buried them. And this at a time when Americans have been embracing neo-Marxist policies.

The problem is whether one can devise an objective formula for a reserve currency that does not depend upon the decisions of political appointees from any one nation, yet will be widely accepted. It may not be done any time soon. There are too many local interests at stake. But the collapse of confidence in the British pound was one of the causes of WW II. I fear the consequences of "deficits don't matter" short-term thinking. That may be convenient for American politicians, but it threatens the role of the dollar as the world's reserve currency, whether there is a replacement for it or not.

- ‹ Previous

- 1

- 2

- 3

- 4

- Next ›

Support GoHaynesvilleShale.com

Top Content

Groups

-

SMACKOVER LITHIUM GROUP …

6 members

-

SMACKOVER LITHIUM GROUP …

5 members

-

Bienville Parish, LA

247 members

-

San Augustine, TX

386 members

-

Natchitoches Parish

402 members

-

Nacogdoches County

194 members

-

SMACKOVER LITHIUM GROUP …

6 members

-

WESTERN HAYNESVILLE

7 members

-

Franklin County, Texas

11 members

-

North Caddo Parish

360 members

Blog Posts

Tuscaloosa Trend Sits On Top Of Poorest Neighbourhood For Decades - Yet No Royalties Ever Paid To The Community -- Why??

In researching the decades-old Tuscaloosa Trend and the immense wealth it has generated for many, I find it deeply troubling that this resource-rich formation runs directly beneath one of the poorest communities in North Baton Rouge—near…

ContinuePosted by Char on May 29, 2025 at 14:42 — 4 Comments

Not a member? Get our email.

© 2025 Created by Keith Mauck (Site Publisher).

Powered by

![]()

| h2 | h2 | h2 |

|---|---|---|

AboutAs exciting as this is, we know that we have a responsibility to do this thing correctly. After all, we want the farm to remain a place where the family can gather for another 80 years and beyond. This site was born out of these desires. Before we started this site, googling "shale' brought up little information. Certainly nothing that was useful as we negotiated a lease. Read More |

Links |

Copyright © 2017 GoHaynesvilleShale.com