Michael Fitzsimmons believes the Natural Gas Glut is over. Do you?

http://seekingalpha.com/article/1947681-the-natural-gas-supply-glut...

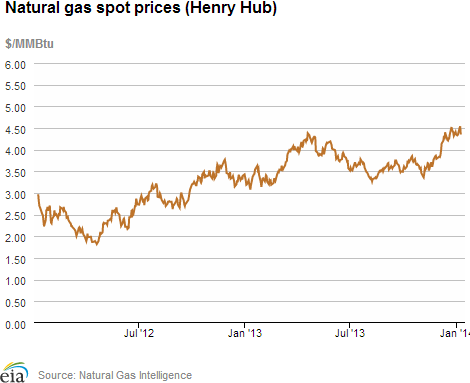

Last week the Energy Information Administration ("EIA") released its weekly natural gas storage report. In my opinion the report established what spot prices have been telling us: the natural gas supply glut is over. While this is bullish and certainly a welcome development for Exxon Mobil (XOM), the #1 producer of natural gas in the US, smaller companies like Cabot Oil & Gas (COG), Chesapeake Energy (CHK) andConocoPhillips (COP) derive a much larger percentage of revenues from domestic natural gas and will therefore see a larger impact on profits.

The sharp increase in natural gas spot prices has been widely reported. More interesting to me is the gas in storage versus the historical 5 year range - the blue line within the gray zone of the chart below. This line is clearly at the low end of the range, and indeed is on the verge of moving outside the range. Although gas in storage was on the low-end of the five-year range throughout much of 2013, it certainly did not start out the year that way. In January of 2013, just as in January of 2012, gas in storage started off the year at the very high end of the five-year range, not the low end, or possibly even below the low-end.

Tags:

Replies to This Discussion

-

Permalink Reply by W. Marshall Shaw on January 24, 2014 at 7:01

Permalink Reply by W. Marshall Shaw on January 24, 2014 at 7:01 -

I might add that the price of oil may soar in the future, especially in the event of another large-scale war, but only on a world market. The odds are good that the placemen in DC may simply expropriate, on their own authority, all privately owned energy properties. One cannot know the future, but there is much greater political risk in US energy investments than there was five years ago.

-

Permalink Reply by Paul M. Hernenko on January 24, 2014 at 8:26

Permalink Reply by Paul M. Hernenko on January 24, 2014 at 8:26 -

The world has changed. The BRIC in its entirety are making various agreements shutting out the dollar. All countries of the BRIC have purchased enormous quantities of gold to make a future currency more than fiat for the mineral transactions demanding stability. The BRIC together are net manufacturers and the Chinese, our creditor, have a rapidly growing ability to add force to its currency choices. America, like it or not, is a nation of consumers with an inability to finance its increasingly leveraged position. Certainly, no one can say what holds. However, to confidently say there could not be a replacement for the dollar because everyone else is in deep doo doo also is as full of garbage as one saying the dollar will soon crater. Our world is changing and even without the changes, the Nixon and John Connolly move to pull all backing for the dollar and make a fiat currency based on Saudi compliance was a risk forty years ago and at the very least remains so.

-

Permalink Reply by W. Marshall Shaw on January 24, 2014 at 5:42

Permalink Reply by W. Marshall Shaw on January 24, 2014 at 5:42 -

I am skeptical about shale D&P booming again any time soon because of the high costs involved. HBP leases are like money in US savings bonds, depreciated but still there.

But may stable prices at the $5 range restore to conventional gas wells a little of their lost luster? It would be a boon to the smallest of our independent operators as well as to service providers and to landowners in every producing province.

You guys know industry economics and dynamics better than I do. Only tangentially a shale topic, but what is the outlook for new conventional wells?

- ‹ Previous

- 1

- 2

- 3

- 4

- Next ›

Support GoHaynesvilleShale.com

Top Content

Groups

-

WESTERN HAYNESVILLE

12 members

-

Sabine Parish, LA

456 members

-

SMACKOVER LITHIUM GROUP …

10 members

-

Natchitoches Parish

405 members

-

Evangeline Parish

17 members

-

Bienville Parish, LA

248 members

-

SMACKOVER LITHIUM GROUP …

8 members

-

North LA Cotton Valley C…

67 members

-

Webster Parish

301 members

-

Cass County, TX

121 members

Blog Posts

Tuscaloosa Trend Sits On Top Of Poorest Neighbourhood For Decades - Yet No Royalties Ever Paid To The Community -- Why??

In researching the decades-old Tuscaloosa Trend and the immense wealth it has generated for many, I find it deeply troubling that this resource-rich formation runs directly beneath one of the poorest communities in North Baton Rouge—near…

ContinuePosted by Char on May 29, 2025 at 14:42 — 4 Comments

Not a member? Get our email.

© 2026 Created by Keith Mauck (Site Publisher).

Powered by

![]()

| h2 | h2 | h2 |

|---|---|---|

AboutAs exciting as this is, we know that we have a responsibility to do this thing correctly. After all, we want the farm to remain a place where the family can gather for another 80 years and beyond. This site was born out of these desires. Before we started this site, googling "shale' brought up little information. Certainly nothing that was useful as we negotiated a lease. Read More |

Links |

Copyright © 2017 GoHaynesvilleShale.com