Will CHK Sell Off Haynesville Assets?

Two analysts at Citigroup (NYSE:C) see Chesapeake fetching as much as $1.25 billion for 150,000 net acres in the Haynesville - cash that would be very welcome. It depends on what part of its position Chesapeake wants to sell, but a deal of this size is very important to note. Even if Chesapeake raises around $650 million-$850 million, that cash will go a very long way in making paying off its 2017 maturities possible.

There is an interesting parallel that can be drawn from Chesapeake's sale of its core Meramec position in the STACK region and the potential sale of some of its Haynesville operations. Before Chesapeake Energy announced it was selling off its Meramec asset, management and investor relations put a lot of effort towards hyping up the positive attributes of the Meramec play. Every presentation, every earnings update, every conference call repeatedly mentioned Chesapeake's promising Meramec program and what was being done to get more and more out of the emerging oil-rich shale play. Then the company sold 42,000 net acres in the STACK region (which houses the Meramec shale) for $470 million.

During this earnings cycle, Chesapeake devoted a lot of real estate in its prepared remarks, conference call, and its earnings presentation to the Haynesville. I would speculate that management is trying to showcase how recent developments, including 10,000-foot laterals and far more intensive completion designs, have fundamentally changed the play (at least to some degree, but management is going to paint a very rosy picture that will be a tad too bullish) in order to woe over possible buyers.

This could also be seen as a sign that Chesapeake is serious about selling off part of its Haynesville operations and is actively laying the groundwork for a future sale. While divestiture targets are nice, they mean little if there isn't a logical way to reach those numbers. Chesapeake Energy appears to want to communicate that there are more sales in the works and investors should expect another major cash infusion, especially with its 2017 maturities on the horizon.

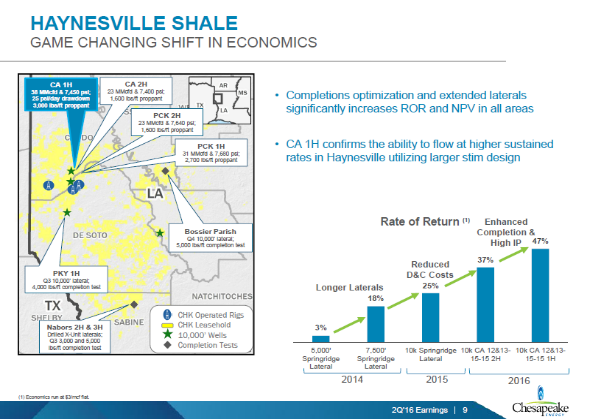

The Haynesville's economics is underpinned by ample natural gas takeaway capacity and access to markets that allows upstream operators to fetch prices close to Henry Hub (compared to the sharp differentials and midstream constraints in the Marcellus/Utica area). Below is a look at how Chesapeake's incremental well economics has improved over time assuming a flat $3/Mcf natural gas price realization.

Source: Chesapeake Energy Corporation Earnings Presentation

On a realistic level, the Haynesville shale play has undergone some major transformations that makes it far more interesting in the face of ample supply out of the Marcellus/Utica region. Doubling the length of well laterals, cutting drilling/completion times, locking in lower third-party rates, cheaper labor costs, and major improvements in well productivity have significantly bolstered Haynesville well economics. However, this is a region that needs a $2.25-$2.50/Mcf+ Henry Hub environment in order to be compelling, which could move lower through continued operational gains. The company is currently running three rigs in the play.

Read more: http://seekingalpha.com/article/3997134-haynesville-divestment-rais...

Tags:

Replies to This Discussion

-

Permalink Reply by Steve P on August 12, 2016 at 12:06

Permalink Reply by Steve P on August 12, 2016 at 12:06 -

Is this your opinion, or based on something more?

The point being made in the article would support the sale of either - just non-core, or all of it. Their PR efforts are clearly trying to pump up the value of the HA holdings. Their continued drilling program fits in nicely with the PR program.

CHK has placed their lot on shale gas, not shale oil or liquids, so selling their core HA holdings could be viewed as a desperate move. But, hey, they are a desperate company so it would not be a huge shock.

-

Permalink Reply by William C. Morrison on August 18, 2016 at 7:07

Permalink Reply by William C. Morrison on August 18, 2016 at 7:07 -

Chesapeake has already bailed out of the Barnett Shale here in Texas. They were going great guns a few years ago and now have sold all their holdings in the entire area. That is they have done so after settling all the law suits. I think they need the cash to settle up the law suits and they have managed to destroy their creditability in the area. So I am not surprised that they are trying to unload Haynesville too. They are strapped for money and they are trying to survive under the present economic conditions in the gas industry. Good riddance says many. Somebody will surely buy their assets in the region, they did so here in Texas.

-

Permalink Reply by olddog573 on August 18, 2016 at 15:23

-

They can double down on me, just buy out Samson

-

Permalink Reply by Skip Peel - Mineral Consultant on August 18, 2016 at 15:31

Permalink Reply by Skip Peel - Mineral Consultant on August 18, 2016 at 15:31 -

Samson has "core" acreage????

-

Permalink Reply by olddog573 on August 18, 2016 at 16:03

-

Actually I have a Samson well that scores better than my CHK wells

- Attachments:

-

-

image.png, 236 KB

image.png, 236 KB

-

-

Permalink Reply by Skip Peel - Mineral Consultant on August 19, 2016 at 2:15

Permalink Reply by Skip Peel - Mineral Consultant on August 19, 2016 at 2:15 -

A Samson HA well with a shale score in the 80's makes me wonder about the accuracy of the scoring program. Which Samson well in particular is yours?

-

Permalink Reply by Skip Peel - Mineral Consultant on August 19, 2016 at 6:40

Permalink Reply by Skip Peel - Mineral Consultant on August 19, 2016 at 6:40 -

That is far less productive than the average HA horizontal well in the play. No way it should score above 50.

I was curious because I have never run across a Samson HA well that was as good or better than average. Most are far below the average.

-

-

Permalink Reply by True Texan on August 19, 2016 at 4:03

Permalink Reply by True Texan on August 19, 2016 at 4:03 -

This explains the packets my family received in regards to our La Salle County wells. In those letters Chesapeake says they want to extend laterals into our pools from other wells and do cost sharing between the pools. I bet they have lower royalty cost in the other pools so they want to link them and suck them dry using the cheapest hole.

-

Permalink Reply by Skip Peel - Mineral Consultant on August 19, 2016 at 4:15

Permalink Reply by Skip Peel - Mineral Consultant on August 19, 2016 at 4:15 -

Laterals producing from multiple units in Texas are referred to as Allocation Wells. The reason all horizontal operators, not just CHK, are drilling these long lateral wells is because they are more cost efficient. The price per unit of hydrocarbon produced is less. The royalty paid, regardless of the percentage of production allocated to each unit, would be the same royalty paid on a well drilled wholly within a unit. Thus there is no advantage to the operator on the royalty end of the equation. If long lateral, multi-unit wells were not allowed, there would be a lot fewer wells drilled because they would not be sufficiently profitable for a company to commit the capital.

Support GoHaynesvilleShale.com

Top Content

Groups

-

SMACKOVER LITHIUM GROUP …

7 members

-

SMACKOVER LITHIUM GROUP …

8 members

-

WESTERN HAYNESVILLE

7 members

-

San Augustine, TX

386 members

-

Natchitoches Parish

402 members

-

Bienville Parish, LA

248 members

-

South Caddo Parish Group

441 members

-

DeSoto Parish

690 members

-

Sabine Parish, LA

455 members

-

Nacogdoches County

194 members

Blog Posts

Tuscaloosa Trend Sits On Top Of Poorest Neighbourhood For Decades - Yet No Royalties Ever Paid To The Community -- Why??

In researching the decades-old Tuscaloosa Trend and the immense wealth it has generated for many, I find it deeply troubling that this resource-rich formation runs directly beneath one of the poorest communities in North Baton Rouge—near…

ContinuePosted by Char on May 29, 2025 at 14:42 — 4 Comments

Not a member? Get our email.

© 2025 Created by Keith Mauck (Site Publisher).

Powered by

![]()

| h2 | h2 | h2 |

|---|---|---|

AboutAs exciting as this is, we know that we have a responsibility to do this thing correctly. After all, we want the farm to remain a place where the family can gather for another 80 years and beyond. This site was born out of these desires. Before we started this site, googling "shale' brought up little information. Certainly nothing that was useful as we negotiated a lease. Read More |

Links |

Copyright © 2017 GoHaynesvilleShale.com