G’day, Lafayette County. There are new players in brine leasing across the Smackover Formation, adding an international dimension to the search for lithium under South Arkansas’ billabongs.

Australian-based Daytona Lithium, a private partnership, controls the brine leases to 5,325 acres abutting ExxonMobil’s newly-acquired brine leases. Daytona’s leases are in central and western Lafayette County toward the Red River.

Daytona also has additional lease offers out to mineral owners in an effort to expand its acreage lease base.

The news came late last week in an announcement by another Australian company, publicly-owned Pantera Minerals. Pantera, headquartered in Perth, said it has purchased a 35 percent interest in Daytona Lithium through a $2 million (Australian dollars) convertible note.

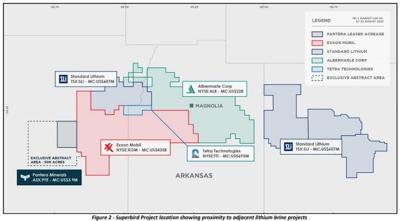

Pantera Minerals’ announcement noted the interest in the lithium-rich brine contained within the Smackover Formation from companies includes ExxonMobil, Albemarle, Tetra Technologies and Standard Lithium.

“The Smackover Formation is considered to be one of the significant lithium regions globally,” Pantera’s announcement said, outlining Daytona Lithium plans for its “Superbird Project.”

“Daytona will continue its aggressive acreage leasing strategy funded by the $2 million investment from Pantera. The 35% project interest is secured via a $2 million convertible note facility into Daytona, supported by a two-tranche placement of 28,571,429 shares at 7 cents per share to raise the $2 million to fund the convertible note facility,” Pantera said.

“Understanding of the mineral ownership is the key element of obtaining lithium brine leases, Daytona has entered into an exclusive agreement with a commercial leasing abstract company, the only such provider for the area of interest, to provide a further 50,000 acres of lease abstract services, an essential service in the lease acquisition process where lithium brine owners rights are accurately identified. This arrangement allows Daytona to quickly make leasing offers to mineral owners -- a key commercial advantage,” said the Pantera statement.

Work is under way to generate a lithium exploration target from the geological and petrophysical data that is available from historical oil and gas exploration and production previously conducted within the Daytona controlled leased acreage.

Daytona will secure brine samples for further analysis and pilot plant direct lithium extraction (DLE) testing.

“With Pantera’s 35% investment into Daytona Lithium, the company enters one of the most significant and emerging brine plays in the USA. Daytona holds highly prospective lithium brine leases in the Smackover Play located in Arkansas,” said Matt Hansen, Pantera’s chief executive officer.

“Daytona’s project area directly abuts Exxon’s Smackover Lithium Brine Project, Standard Lithium’s Lanxess and South West Arkansas Project and Albemarle Corporation's Lithium-Bromine Brine Project. Confirming the Smackover’s Tier 1 lithium brine status was Exxon’s entrance into the region, marked by a reported $100 million (U.S.) acquisition of over 100,000 acres of private leases and their subsequent agreement with Tetra Technologies Inc.. to develop a further 6,000 lithium-rich acres in Arkansas to produce 75,000-100,000 metric tons annually, equaling 15% of the world's lithium production last year.

“The Smackover Play is fast becoming recognized as a leading play globally for lithium brine production with a long-established bromine brine extraction industry and a hundred years of oil and gas well data available. We look forward to working with the Daytona team with the aim of increasing the leased area and generating a lithium exploration target in the short term and creating value by providing shareholders with exploration exposure to this exciting battery metals project,” Hansen said.

The Pantera statement said that Daytona’s Superbird Project covers a land position of 5,325 leased acres of lithium brine prospective ground, with a further 7,000 acres under negotiation. Daytona is also considering a second target area for leasing up to 50,000 acres will continue to increase its land position and Pantera looks forward to updating shareholders with increased project acreage.

“Daytona has entered into an exclusive agreement with a commercial abstract company, being the only company that provides the mineral ownership abstract information for the Project Area. Importantly, understanding of the mineral ownership is the key element of obtaining lithium brine leases,” the Pantera statement said.

“This is a key commercial advantage to Daytona providing the company with mineral ownership records confirming the mineral owners and ensuring that leases entered into are with the correct mineral owners (mineral rights can be severed from surface rights in the USA and records dating back to the 1800’s must be examined to ensure correct mineral right ownership).

“The exclusive agreement is for a term of 6 months and contains an option to extend for a further two 6-month terms. This provides a key advantage in that Daytona will be able to acquire the required accurate mineral ownership information from the project area more quickly than its competitors.

“Although this information can be obtained from public records, it is a timely and (labor-intensive) process,” the Pantera statement said.

(This article was the result of a tip from a magnoliareporter.com reader.)