Michael Fitzsimmons believes the Natural Gas Glut is over. Do you?

http://seekingalpha.com/article/1947681-the-natural-gas-supply-glut...

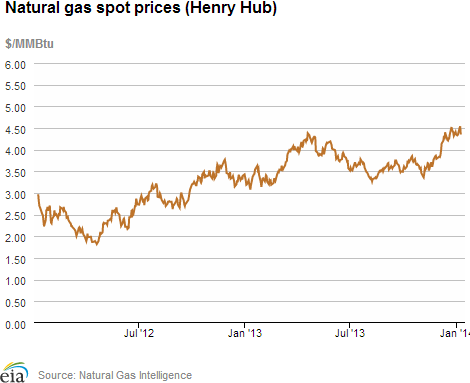

Last week the Energy Information Administration ("EIA") released its weekly natural gas storage report. In my opinion the report established what spot prices have been telling us: the natural gas supply glut is over. While this is bullish and certainly a welcome development for Exxon Mobil (XOM), the #1 producer of natural gas in the US, smaller companies like Cabot Oil & Gas (COG), Chesapeake Energy (CHK) andConocoPhillips (COP) derive a much larger percentage of revenues from domestic natural gas and will therefore see a larger impact on profits.

The sharp increase in natural gas spot prices has been widely reported. More interesting to me is the gas in storage versus the historical 5 year range - the blue line within the gray zone of the chart below. This line is clearly at the low end of the range, and indeed is on the verge of moving outside the range. Although gas in storage was on the low-end of the five-year range throughout much of 2013, it certainly did not start out the year that way. In January of 2013, just as in January of 2012, gas in storage started off the year at the very high end of the five-year range, not the low end, or possibly even below the low-end.

Tags:

Replies to This Discussion

-

Permalink Reply by Skip Peel - Mineral Consultant on January 16, 2014 at 9:46

Permalink Reply by Skip Peel - Mineral Consultant on January 16, 2014 at 9:46 -

No, Bobi. I don't. The bulk of recent articles I have read project $4 to $4.50 for the next two years.

-

Permalink Reply by jim weyland on January 16, 2014 at 9:55

-

imo, you're spot on.

the traditional exploration business model was/is "risk" based. you know, the old one out of ten rank wildcats would prove commercial. its still the model offshore and most wise overseas.

imo, the radical change that shale, and other types of tight production represents is because it operates under a new and different (at least insofar so to e&p ) business model. there, tight gas/oil, economics are more closely aligned with a manufacturing environment. in such endeavors, at the end of the day, the low cost producer, manufacturer, always wins.

and, like manufacturing, you know your raw material is there and it ain't going away. so, you manufacture, in this case, drill, when the economics are right.

in the case of shale, there's way more already identified "raw material" than the market can now absorb. and, of course, that's why all the new build projects relying on economic gas supply are being announced/built. these folks are "voting with their pocketbooks". my guess being they're using a 20 year profile. in a related note, the first nymex print over $5.00/MMBtu is Jan '23. and, there, those folks are voting with their pocket books, also

today's lowest cost "manufacturers" are operating in the bakken, eagle ford and their likes. of course, it's their liquids that make them the low cost producer.

dry gas plays where the leases are hbp will not drill again anytime soon. that is until market demand more = supply. let's all root for the new markets, including including, hopefully, unconstrained lng exports.

-

Permalink Reply by ledlights on January 16, 2014 at 10:50

Permalink Reply by ledlights on January 16, 2014 at 10:50 -

I agree with Jay and Skip.

Seeking Alpha articles frequently contain their best content in the comments, although the comment trails can often be so long that they are extremely hard to get through. I found the knowledgeable comments from okoil and Bill Simoes to be the most interesting concerning both the current market situation and the predictability of shale gas production.

-

Permalink Reply by Frank on January 16, 2014 at 14:01

Permalink Reply by Frank on January 16, 2014 at 14:01 -

The price of a commodity called natural gas seems much less reactive to weather and inventory projections of late just as the hurricane influence did before disappearing. It still seems to be undervalued for drilling purposes. I think it is seeking a long term level price after the recent bubble just as it almost exhibited after Katrina before the shortage scare prior to the bubble. It's been really volatile in the past 20 years compared to the history before. I see $5 as a pretty hard cap to cross.

-

Permalink Reply by kelandonahue on January 17, 2014 at 6:08

Permalink Reply by kelandonahue on January 17, 2014 at 6:08 -

This article seems to ignore two things:

1) The previous year or two had extremely high levels of natural gas storage levels, which no doubt inflated the five-year inventory levels. Combine that with a cold winter, and you have your reason as to why the levels are low in comparison to the five-year average.

2) The article made no mention of flaring, which is a pretty big elephant in the room. Natural gas is flared at massive levels. For the glut of natural gas to be over, flared natural gas needs to be accounted for.

-

Permalink Reply by jim weyland on January 17, 2014 at 6:50

-

this is relevant to your 2)

http://www.eia.gov/dnav/ng/ng_prod_sum_a_epg0_vgv_mmcf_a.htm

given it's a government thing, it may need to taken with a touch of salt.

-

Permalink Reply by Skip Peel - Mineral Consultant on January 17, 2014 at 6:53

Permalink Reply by Skip Peel - Mineral Consultant on January 17, 2014 at 6:53 -

Interesting graph for North Dakota.

-

Permalink Reply by jim weyland on January 17, 2014 at 7:04

-

the states all seem to look the other way when the flared gas is associated with bodacious liquids production. they all want the severance tax revenue attributable to the liquids and they want it now.

what i don't know is whether severance tax is payable on flared production. maybe, no, it's likely, someone here does know.

-

Permalink Reply by kelandonahue on January 17, 2014 at 7:23

Permalink Reply by kelandonahue on January 17, 2014 at 7:23

-

Permalink Reply by jim weyland on January 17, 2014 at 7:37

-

thank you, sir.

-

Permalink Reply by kelandonahue on January 17, 2014 at 7:16

Permalink Reply by kelandonahue on January 17, 2014 at 7:16 -

Appreciate the data, but I think I phrased that second portion poorly. When I said accounted for, I meant taken into account, not actually measured. I'm aware the measurements are out there.

That's a 28% increase in REPORTED flaring from 2010 to 2012. That's a lot of gas, and once the demand and price of natural gas increase, this gas will hit the market, continuing the glut. Basically, this data right here shows that the glut is not over or anywhere close to it.

-

Permalink Reply by 1kw6x71km1v37 on January 17, 2014 at 10:48

-

Those figuring on a long-term gas glut should counter in the high decline rate of shale wells and the reduction in drilling for dry gas after having been overdrilled the past few years, resulting in the current glut. The world is not going to get natural gas on the cheap forevermore. At some point, the piper will be paid for his tunes.

Support GoHaynesvilleShale.com

Top Content

Groups

-

WESTERN HAYNESVILLE

12 members

-

Sabine Parish, LA

456 members

-

SMACKOVER LITHIUM GROUP …

10 members

-

Natchitoches Parish

405 members

-

Evangeline Parish

17 members

-

Bienville Parish, LA

248 members

-

SMACKOVER LITHIUM GROUP …

8 members

-

North LA Cotton Valley C…

67 members

-

Webster Parish

301 members

-

Cass County, TX

121 members

Blog Posts

Tuscaloosa Trend Sits On Top Of Poorest Neighbourhood For Decades - Yet No Royalties Ever Paid To The Community -- Why??

In researching the decades-old Tuscaloosa Trend and the immense wealth it has generated for many, I find it deeply troubling that this resource-rich formation runs directly beneath one of the poorest communities in North Baton Rouge—near…

ContinuePosted by Char on May 29, 2025 at 14:42 — 4 Comments

Not a member? Get our email.

© 2026 Created by Keith Mauck (Site Publisher).

Powered by

![]()

| h2 | h2 | h2 |

|---|---|---|

AboutAs exciting as this is, we know that we have a responsibility to do this thing correctly. After all, we want the farm to remain a place where the family can gather for another 80 years and beyond. This site was born out of these desires. Before we started this site, googling "shale' brought up little information. Certainly nothing that was useful as we negotiated a lease. Read More |

Links |

Copyright © 2017 GoHaynesvilleShale.com