Seeking Alpha / The Century For Natural Gas

http://seekingalpha.com/article/185979-the-century-for-natural-gas-...

In the 19th century, coal overcame wood as the world's most important fuel. The 20th century was the age of petroleum, thanks to the popularity and prevalence of the automobile.

Coal and oil will remain key energy commodities well into the 21st century, but I expect natural gas to increase its share of the global energy mix substantially. The long-term drivers of demand for natural gas are twofold: relative abundance and environmental friendliness.

The rapid development of massive US unconventional natural gas plays has changed the supply outlook for the world's largest gas consumer. Just a few years ago, most forecasted that the US would need to import ever-larger quantities of liquefied natural gas (LNG) to meet growing demand; domestic supplies were dwindling, and Canada would no longer be able to supply enough gas via pipeline to meet demand.

But in recent quarters, America's problem has been one of too much natural gas; as recently as two months ago, many investors fretted over the potential for US gas storage to reach capacity. A severe economic downturn crippled domestic demand for natural gas conspired with a surge in supply from unconventional gas plays to test the limits of US storage facilities.

A drilling boom amid high gas prices in early 2008 meant there were a large number of new wells feeding gas into the country's storage facilities through much of 2009. US gas production didn't top out until February, according to data from the Energy Information Administration (EIA). That production decline didn’t stem from a lack of reserves, but low prices that prompted producers to sharply reduce drilling activity through late 2008 and early 2009.

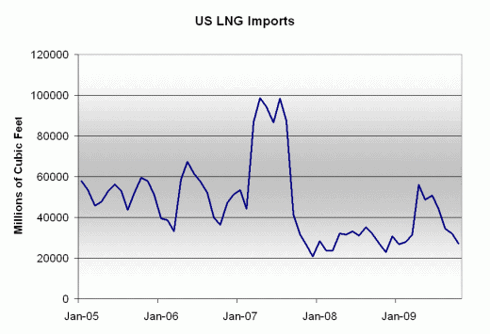

Thanks to abundant domestic supply, US imports of liquefied natural gas have remained subdued in recent years.

Source: EIA

As you can see, imports experienced a seasonal bump around midsummer but generally hovered around depressed levels throughout 2008 and 2009.

Natural gas prices in the US remain around USD5.50 per million British thermal units, less than half their 2008 highs. This price level is shocking given that US gas storage is slightly below the five-year average, thanks to a prolonged patch of frigid temperatures across the country. Only a few weeks ago, most analysts expected storage levels to be well above average at the end of this year's heating season.

This reflects the ongoing realization that some of North America's unconventional natural gas fields offer attractive economics when gas prices are relatively low. The magic price needed to incentivize production sufficient to meet demand in a "normal" year varies widely. But the consensus among producers is that the marginal price of natural gas is around USD7 per million British thermal units--a reasonable estimate for the average price of gas in coming years.

There are also longer-term demand-side drivers for gas. Natural gas emits 50 to 60 percent less carbon dioxide (CO2) than coal to produce the same amount of electricity. And gas also emits far less of other pollutants, including sulfur dioxide, nitrous oxides and mercury. This makes it the fuel of choice for electricity generators looking to build new capacity amid uncertainty over future carbon and environmental regulation.

The election of Republican Scott Brown to the US Senate this month eliminates the Democrat's super-majority in the Senate. This makes it highly unlikely that Congress will pass a carbon cap-and-trade bill to control CO2 emissions this year.

Instead, I suspect Congress will try to enact a scaled-down energy bill that focuses heavily on popular carrots--subsidies, tax credits and loan guarantees--and can attract bi-partisan support. Natural gas should benefit from this strategy.

A bill currently making its way through the US Congress would offer significant tax credits and incentives for natural gas-powered vehicles. If approved, the Alternative Transportation to Give Americans Solutions Act of 2009 (HR1835) also would mandate that 50 percent of vehicles purchased or placed into service by the US government by the end of 2014 be capable of burning natural gas fuels. And the act also authorized the Dept of Energy to invest in research and development for gas-fueled vehicles. Some of the bill’s provisions or similar proposals could make their way through Congress with fairly broad bipartisan support and would act as another catalyst for gas.

I appeared on the Clean Skies network last Thursday to discuss the weekly oil inventory and natural gas storage reports from the EIA and my outlook for prices. The morning show that day also included a detailed discussion of ExxonMobil’s (NYSE: XOM) proposed takeover of US unconventional natural gas producer XTO Energy (NYSE: XTO).

That hearing before the House Energy and Environment Committee was largely positive; members recognized the key role that natural gas will play in meeting future energy demand in an environmentally friendly manner. Members on both sides of the aisle also appeared to talk down the potential for onerous federal regulation of hydraulic fracturing, a key technique used in unconventional gas production.

Several sectors will benefit from increased use of natural gas. Perhaps the most obvious beneficiaries are producers with significant acreage in the primary unconventional plays such as the Haynesville Shale of Louisiana and the Marcellus Shale in Appalachia. Any gas producer with heavy exposure to unconventional gas can also be considered a takeover target; Exxon's acquisition of unconventional-focused XTO Energy is likely to act as a blueprint for other major integrated oil companies to enter the space. Already this year, Chesapeake Energy (NYSE: CHK) announced a major joint venture in the Barnett Shale with Paris-based giant Total (NYSE: TOT).

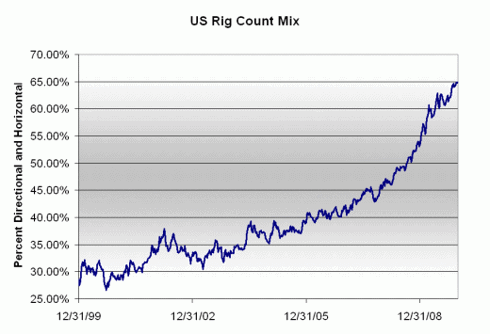

Services firms with a strong market position in key techniques for unconventional gas production will also benefit. Check out the graph below.

Source: Bloomberg

To calculate the data points in this graph, I divided the number of directional and horizontal drilling rigs actively working in the US by the total number of rigs working in the nation. As you can see, less than 30 percent of the rigs working in the US were rigs capable of drilling directional and horizontal wells at the turn of the last decade. Now, close to 65 percent of rigs in the US boast these capabilities.

Also note the pattern in this graph. The line rose rather gradually from 2000 through roughly the beginning of 2007. Since then, however, the ratio has gone parabolic--the trend has accelerated.

This simple chart has two key implications. First, in most cases, successfully producing unconventional natural gas shale plays such as the Haynesville and Marcellus requires the use of horizontal wells and drilling such wells requires rigs capable of drilling horizontally. Historically, land rigs have been thought of as rather low-tech compared to their offshore cousins, but drilling lengthy horizontal well segments through shale requires a powerful rig.

That a larger proportion of US rigs boast these advanced capabilities is simply a reflection of the rising importance of unconventional gas and gas shale plays to US production.

A more important implication from an investment standpoint is that a good deal more work goes into drilling a horizontal well in a shale field than drilling a traditional vertical well in a conventional reservoir. For example, producing shale reservoirs requires the use of fracturing--pumping liquid and sand into a field under immense pressure to improve permeability. Some of the most advanced wells drilled in unconventional gas plays employ fracturing in a series of carefully planned stages.

And there are several other technologies and services that are required to drill unconventional wells.

Each unconventional well drilled in the US spells several times as much business for services and drilling firms than conventional wells. Although the US total rig count remains well off its 2008 highs, the increasing importance of directional rigs suggests that more activity is being directed toward unconventional fields--and that spells more business for services firms with exposure to gas-levered services.

And it's important to remember that natural gas isn't solely a US-focused story. While technologies related to unconventional gas production have largely been developed and tested in North America, the continent does not have a lock on shale plays. Clearly, Exxon's takeover of XTO reflects its long-stated position that growth in natural gas demand would outstrip oil and coal in coming years.

However, Exxon also owns acreage in promising shale fields across Europe. The oil giant undoubtedly plans to leverage XTO's expertise abroad. The potential for international shale gas coupled with supply from new LNG facilities should also make gas more plentiful abroad as well--better resource availability will stimulate demand growth. This opens up myriad new international markets for American services firms with expertise in unconventional plays.

Tags:

Replies to This Discussion

-

Permalink Reply by LP on February 3, 2010 at 0:32

Permalink Reply by LP on February 3, 2010 at 0:32 -

Would be nice...and patriotic if Exxon would concentrate it's interest in US resources, at least until the US has recovered from the economic disaster before it sends the "XTO's expertise abroad".

I know....it's all about the bottom line rather than the border line.

Support GoHaynesvilleShale.com

Top Content

Groups

-

WESTERN HAYNESVILLE

15 members

-

Bienville Parish, LA

249 members

-

SMACKOVER LITHIUM GROUP …

10 members

-

SONRIS Help Center

255 members

-

Natchitoches Parish

405 members

-

Sabine Parish, LA

456 members

-

Evangeline Parish

17 members

-

SMACKOVER LITHIUM GROUP …

8 members

-

North LA Cotton Valley C…

67 members

-

Webster Parish

301 members

Blog Posts

Tuscaloosa Trend Sits On Top Of Poorest Neighbourhood For Decades - Yet No Royalties Ever Paid To The Community -- Why??

In researching the decades-old Tuscaloosa Trend and the immense wealth it has generated for many, I find it deeply troubling that this resource-rich formation runs directly beneath one of the poorest communities in North Baton Rouge—near…

ContinuePosted by Char on May 29, 2025 at 14:42 — 4 Comments

Not a member? Get our email.

© 2026 Created by Keith Mauck (Site Publisher).

Powered by

![]()

| h2 | h2 | h2 |

|---|---|---|

AboutAs exciting as this is, we know that we have a responsibility to do this thing correctly. After all, we want the farm to remain a place where the family can gather for another 80 years and beyond. This site was born out of these desires. Before we started this site, googling "shale' brought up little information. Certainly nothing that was useful as we negotiated a lease. Read More |

Links |

Copyright © 2017 GoHaynesvilleShale.com