Haynesville Shale Production - 2013 Will Be The Year It Finally Starts Dropping

Seeking Alpha October 29, 2012

It has been a frustrating few years for investors who are long natural gas either directly or through producers.

I believe we may be close to finally getting some support for prices as production from the Haynesville shale starts to roll over.

And I for one say that it is about time!

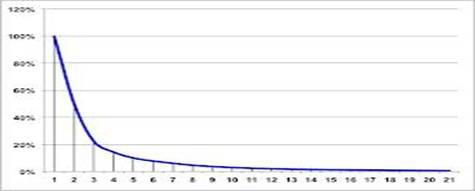

One thing that we know about shale gas and shale oil production is that the wells come on very strong and then the rate of production declines very quickly.

After one year, the level of production drops by 65% to 80%. After two years, it drops another 35%. If producers stop drilling wells, the level of production is going to drop very quickly.

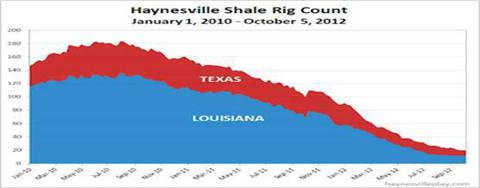

In the Haynesville Shale in 2012, the industry has pretty much stopped drilling:

From a peak of 180 in 2010, the number of wells active in the Haynesville hasn't dropped, it has plummeted. As of the most recent update, the Haynesville rig count stands at just over 20, as producers such as Chesapeake Energy (CHK) have finally stopped drilling.

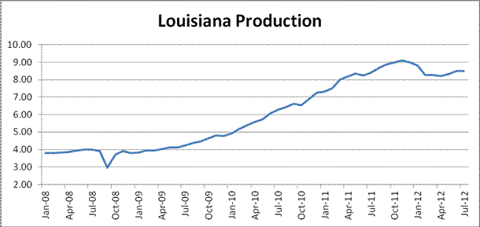

Despite this rig count decline, production has been stubbornly flat:

I believe that we are on the verge of Haynesville production rolling over and this drop in rigs showing up. The CEO of Ultra Petroleum (UPL)agrees and estimates that Haynesville production could drop 10% per quarter at the current rig count level.

That would mean a 2.5 billion cubic feet per day reduction over the course of a year for the Haynesville Shale, which would make a significant difference to the supply and demand relationship for the entire country.

I admit to being surprised that the Haynesville production hasn't started declining prior to now. I believe the reason it hasn't is that there is a delay between when a well is drilled and when it is actually placed on production.

Therefore, the Haynesville production we have seen so far in 2012 is more indicative of the number of drilling rigs that were working in 2011, which in 2011 averaged 130 (started at 160 and ended at 100). In 2013 and in the final months of 2012 we are going to see the impact of the number of drilling rigs active in 2012 which has seen a decrease from 100 to 20.

So while I'm not about to pound the table about now being the time to get exposed to natural gas (UNG) investments, I am willing to suggest that things are about to get a little bit better.

http://seekingalpha.com/article/957771-haynesville-shale-production...

Tags: Haynesville Shale, Natural Gas

Replies to This Discussion

-

Permalink Reply by Skip Peel - Mineral Consultant on October 31, 2012 at 5:07

Permalink Reply by Skip Peel - Mineral Consultant on October 31, 2012 at 5:07 -

Larry, the reason for the high initial production in horizontal Haynesville wells is that the formation is naturally "over-pressured". This has been not only known but touted since the very first announcements. And has nothing to do with the hydraulic fracture stimulation process.

- ‹ Previous

- 1

- 2

- Next ›

Support GoHaynesvilleShale.com

Top Content

Groups

-

Natchitoches Parish

405 members

-

WESTERN HAYNESVILLE

17 members

-

Bienville Parish, LA

249 members

-

SMACKOVER LITHIUM GROUP …

10 members

-

SONRIS Help Center

255 members

-

Sabine Parish, LA

456 members

-

Evangeline Parish

17 members

-

SMACKOVER LITHIUM GROUP …

8 members

-

North LA Cotton Valley C…

67 members

-

Webster Parish

301 members

Blog Posts

Tuscaloosa Trend Sits On Top Of Poorest Neighbourhood For Decades - Yet No Royalties Ever Paid To The Community -- Why??

In researching the decades-old Tuscaloosa Trend and the immense wealth it has generated for many, I find it deeply troubling that this resource-rich formation runs directly beneath one of the poorest communities in North Baton Rouge—near…

ContinuePosted by Char on May 29, 2025 at 14:42 — 4 Comments

Not a member? Get our email.

© 2026 Created by Keith Mauck (Site Publisher).

Powered by

![]()

| h2 | h2 | h2 |

|---|---|---|

AboutAs exciting as this is, we know that we have a responsibility to do this thing correctly. After all, we want the farm to remain a place where the family can gather for another 80 years and beyond. This site was born out of these desires. Before we started this site, googling "shale' brought up little information. Certainly nothing that was useful as we negotiated a lease. Read More |

Links |

Copyright © 2017 GoHaynesvilleShale.com