Clean Energy Unveils Backbone Network for America’s Natural Gas Highway

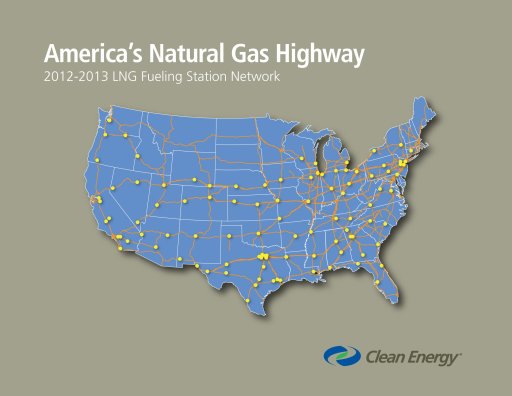

SEAL BEACH, Calif.--(BUSINESS WIRE)-- The route plan for the first phase of 150 new LNG fueling stations for America’s Natural Gas Highway (ANGH) was unveiled today by Clean Energy Fuels Corp. (Nasdaq: CLNE - News), the leading provider of natural gas fuel for transportation in North America. The company has identified 98 locations and anticipates having 70 stations open by the end of 2012 in 33 states.

Many of the fueling stations will be co-located at Pilot-Flying J Travel Centers already serving goods movement trucking through an exclusive agreement with Pilot to build, own and operate natural gas fueling facilities at agreed-upon travel centers. Pilot-Flying J is the nation's largest truck-stop operator with more than 550 retail properties in 47 states.

Major highway segments planned for early opening include, among others, those linking San Diego-Los Angeles-Riverside-Las Vegas; the Texas Triangle (Houston-San Antonio-Dallas/Ft. Worth); Los Angeles-Dallas; Houston-Chicago; Chicago-Atlanta; and a network of stations along major highways in the mid-west region (IL, IN, OH, MO, KY, TN, KS, OK, AL) to serve the heavy trucking traffic in the area.

Scheduled for completion during 2012 and 2013, the 150 first-phase stations coincide with the expected arrival of new natural gas truck engines well suited for heavy-duty, over-the-road trucking. Engine manufacturers and original equipment truck manufacturers such as Cummins-Westport, Kenworth, Peterbilt, Navistar, Freightliner and Caterpillar are expected to have Class-8 trucks available in engine sizes allowing for varied road and driving requirements.

“We are moving quickly to build this important network in order to support the new trucks,” said Andrew J. Littlefair, Clean Energy’s President and CEO. “Already, Clean Energy has engaged over 100 shippers, private fleets and for-hire carriers that have shared their operations to qualify the economic opportunity of operating natural gas trucks, which has helped us, in turn, plan the first phase of the natural gas fueling highway.”

Littlefair noted that the ANGH stations are in addition to the station building planned for the company’s traditional markets in transit, refuse, airport/taxi/shuttle and local/regional trucking, which activity accounted for 63 station projects in 2011.

In July 2011, in a major alliance supporting the transition of trucking from diesel to natural gas fuel, Chesapeake Energy Corporation (NYSE: CHK - News), the nation’s second largest natural gas producer, committed an investment of $150 million in Clean Energy to help fund the development of America’s Natural Gas Highway. In September 2011, a group of international investors committed an additional $150 million, and in December 2011, another $150 million was invested, bringing the total investment in Clean Energy in 2011 for fueling station infrastructure development and other capital projects to $450 million.

Currently priced up to $1.50 per gallon lower than diesel or gasoline (depending upon local markets), the use of natural gas fuel reduces costs significantly for vehicle and fleet owners, and reduces greenhouse gas emissions approximately 23% in medium to heavy-duty vehicles. Additionally, natural gas is a secure North American energy source with 98% of the natural gas consumed produced in the U.S. and Canada.

Tags:

Replies to This Discussion

-

Permalink Reply by DrWAVeSport Cd1 on January 18, 2012 at 8:37

-

David R,

Per $1Billion vs $250 Million initial Capital Outlay... You are correct.

I see the LNG application for Heavy Duty/Class A Trucking across U.S. vs diesel costs. Truck in the LNG just like diesel/gasoline is Trucked.

However, I still don't believe Mr. Powers' $$$/numbers... What's the monthly costs for stations going to be to keep the LNG at -160C in "tanks?" CNG $1B over diesel capital outlay...??? (If I 'read' heard correctly)... And, I don't believe 99% of Gas Stations...go back...and add additional pumps after the fact... Pretty much done when constructed.

Local/State Governments are not investing in CNG Stations because their "costs" supersede LNG Stations' "costs." The "$30K" per month electric bill is another big ????? for me. Maybe out in Timbuk2 but still doesn't compute for me.

Still Scratching My Head here.

Will investigate futher with Shreveport/Bossier investment/cost/monthly expenses per their CNG pumps...

LNG and CNG side-by-side... We need the "demand" side of both.

Standing Corrected... Thanks again for the 'video' find.

DrWAVeSport Cd1 1/18/2012

-

Permalink Reply by DavidR on January 18, 2012 at 9:37

-

I sure don't know enough about it to argue the #s with that guy. I assume they have a feel for the averages on utilities, etc., and it is very expensive when you start talking about 2MW of demand. But beyond that, I just wouldn't know.

It could be they're trying to push the business toward LNG because the capital costs are smaller and just trying to boost the disparity somewhat, but the numbers don't seem insane.

-

Permalink Reply by DrWAVeSport Cd1 on January 18, 2012 at 10:40

-

DavidR,

Good Discussion...

-

Permalink Reply by CuriousKen on January 19, 2012 at 1:52

-

David, thanx for sharing this link. I find it particularly informative regarding the discusion on LNG vs CNG for range per fill. The problem I have with the initial "financial comparison" of infrastructure is that their comparison is faulty to the extreme. The CNG scenario looked at the cost of a filling station from the natural gas pipe supply thru the filling pump. The LNG scenario was NOT comparable in that it failed to include the cost of the off-site LNG conversion plant and the truck/transportation cost to the fueling station. That is to say this was NOT an apples to apples comparison. For "apples to apples" they must include the cost of the plant (and transportation from plant to filling station) that converts NG from pipe to LNG. I understand that an LNG conversion plant would supply several filling stations, but still this investment requirement for an "apples to apples" comparison was NOT included as it should be.

-

Permalink Reply by DavidR on January 19, 2012 at 4:10

-

You make a good point.

There is no doubt that CLNE would prefer the industry "standardizes" on LNG, not CNG. After all, they stand to make money on LNG processing and delivery (to non-company operators), whereas they don't on CNG.

I would say this is a big roll of the dice for CLNE; it is a nascent business and they believe they have an opportunity to establish a "standard" for OTR trucks to run on LNG, which could turn them into a really substantial business over the next 20 years. If Exxon or BP or whoever decided to get into this business, they'd make the same choice, because they, too, stand to gain more on LNG than on CNG.

I don't think this was intended as an apples to apples comparison. I think it was intended as a sales pitch. And in a sales pitch, they're permitted to present what they want to to make their case. I can't fault them for that.

I don't know that a small organization like CLNE would be able to raise the necessary capital to do the project for CNG, however. Either way, LNG or CNG, you've got 150 stores that are going bleed red ink for many, many months. It makes sense to try to keep fixed operating costs as low as possible.

So, while the numbers present "their" case and probably not a "fair", all-in comparison of the two, there is a significant disparity in both the capital expenditure and the ongoing monthly fixed costs during the startup period between CNG & LNG. At some point, when volume is sufficient, CNG might look more attractive to store operators, but that time may be very far away. And CLNE has every reason to want LNG to become a standard or at least predominant.

It is worth pointing out that Pickens recently sold his shares in CLNE.

-

Permalink Reply by True Texan on January 18, 2012 at 8:15

Permalink Reply by True Texan on January 18, 2012 at 8:15 -

IT'S ABOUT TIME! I feel our government has been holding this back for a very, very long time. How can it be that 3rd world countries have been using LNG in taxies, buses, and trucks for many, many years? In Peru they can convert a car to run on both gas and LNG for about $900.00. The only problem is when you need to clime a mountain you have to switch a toggle switch to go to gas so that you have more power. The switch can be made while the car is running at any speed. Maybe the Feds are making to much money off of the import and refining of oil. The reason for our high prices at the pump right now is we are exporting so much gas and bio diesel. This needs to stop because we are polluting America and then not wreaking the rewards. I feel we should all be saying no to this tar sand oil being shipped to the Houston area. What are they going to do with what is left after they remove the oil from it? Why can’t they process this tar sand oil in Canada if they have so much of it?

-

Permalink Reply by JHH on January 18, 2012 at 11:03

Permalink Reply by JHH on January 18, 2012 at 11:03 -

The XL Pipeline permit has been denied. Republicans blamed. There you go!

- ‹ Previous

- 1

- 2

- Next ›

Support GoHaynesvilleShale.com

Top Content

Groups

-

WESTERN HAYNESVILLE

15 members

-

Bienville Parish, LA

249 members

-

SMACKOVER LITHIUM GROUP …

10 members

-

SONRIS Help Center

255 members

-

Natchitoches Parish

405 members

-

Sabine Parish, LA

456 members

-

Evangeline Parish

17 members

-

SMACKOVER LITHIUM GROUP …

8 members

-

North LA Cotton Valley C…

67 members

-

Webster Parish

301 members

Blog Posts

Tuscaloosa Trend Sits On Top Of Poorest Neighbourhood For Decades - Yet No Royalties Ever Paid To The Community -- Why??

In researching the decades-old Tuscaloosa Trend and the immense wealth it has generated for many, I find it deeply troubling that this resource-rich formation runs directly beneath one of the poorest communities in North Baton Rouge—near…

ContinuePosted by Char on May 29, 2025 at 14:42 — 4 Comments

Not a member? Get our email.

© 2026 Created by Keith Mauck (Site Publisher).

Powered by

![]()

| h2 | h2 | h2 |

|---|---|---|

AboutAs exciting as this is, we know that we have a responsibility to do this thing correctly. After all, we want the farm to remain a place where the family can gather for another 80 years and beyond. This site was born out of these desires. Before we started this site, googling "shale' brought up little information. Certainly nothing that was useful as we negotiated a lease. Read More |

Links |

Copyright © 2017 GoHaynesvilleShale.com