Australia oil and gas

Has anyone heard of this new company that seems to have partnered with Paloma Resources?

Tags:

Replies to This Discussion

-

Permalink Reply by Skip Peel - Mineral Consultant on February 3, 2016 at 3:55

Permalink Reply by Skip Peel - Mineral Consultant on February 3, 2016 at 3:55 -

Jennifer, where did you run across the Australis/Paloma connection? Here's a little more company background.

Stars align for exciting options

7 February 2015 The West Australian (c) 2015, West Australian Newspapers Limited

A year after orchestrating a sweetly timed $1.8 billion payday, the team behind Aurora Oil & Gas is closing in on a comeback deal bankrolled by Australian and foreign investors.

Their new vehicle, Australis Oil & Gas, has narrowed its search for a “material” acquisition in the US shale sector and is ready to act after months of evaluation and modeling.

“We're pretty much ready to engage now,” said Jon Stewart, who led Aurora as executive chairman for its nine years and is one of Australis' three foundation shareholders.

“We've identified a number of things we're interested in but we're not yet negotiating.”

The company is no rush but admits less volatile oil prices are providing more comfort and clarity around the timing of its move.

“While you don't need to pick the bottom or the top of the market, we do want to have a sense of confidence where we think they are heading,” Mr Stewart said.

“I think more or less we've had the bottom . . . it doesn't mean they're going to settle at these prices. And, anyway, we're taking a much longer view.”

Under Mr Stewart, Aurora was one of the earliest Australian players in US shale, picking up what were to become coveted assets in the Eagle Ford shale in Texas for a song in 2004.

Its foresight culminated in a $1.8 billion takeover offer by Baytex last February, with the deal eagerly approved by an Aurora shareholders meeting in June, just a stone's throw from Australis' Subiaco premises.

Given the collapse in oil prices late last year and its impact on oil and gas asset values, it proved a well-timed deal.

And Australis now has the chance to repeat Aurora's success by taking advantage of the weak market and again snapping up assets on the cheap, albeit with more competition.

Mr Stewart, who pocketed $80 million from the takeover, said while Australis had scouted other investment destinations, the lure of the US was too strong.

“We felt most comfortable where we had the strongest knowledge base and experience, and where we felt we understood the operating environment, cost structures and performance,” he said. “On top of that, as the oil price came off significantly, we found we could buy a lot more of the sort of quality assets we were interested in for the same dollars.”

Australis is seeking material, quality energy reserves and will probably have the capacity to spend as much as $200 million by the time it comes to pull the trigger on an acquisition.

“We are very focused on the focus of the rock and the economics,” Mr Stewart said. “That is more important than our percentage ownership of the assets. Because high-quality assets are still cash generative at current prices, but lesser-quality assets are losing money.”

Australis' indicative backers include Aurora shareholders and new international investors punting on the Australis team.

“I don't think we would have any difficulty at all pulling together $100 million (of equity), but . . . acouple of hundred million is a pretty good number at the moment in terms of some of the opportunities we see,” Mr Stewart said.

He said also Australis may avoid the short-term investment focus of the sharemarket and remain in private ownership while it adds value to its assets and awaits better markets. It would then float at a time of its choosing, “when the stars are aligned”. He rejected any suggestion that Aurora's success put more pressure on him and his reunited team,

-

Permalink Reply by Skip Peel - Mineral Consultant on February 3, 2016 at 4:27

Permalink Reply by Skip Peel - Mineral Consultant on February 3, 2016 at 4:27 -

Thanks, Oilman. Paloma could use the help to meet their drilling commitments.

-

Permalink Reply by Jennifer on February 3, 2016 at 4:40

Permalink Reply by Jennifer on February 3, 2016 at 4:40 -

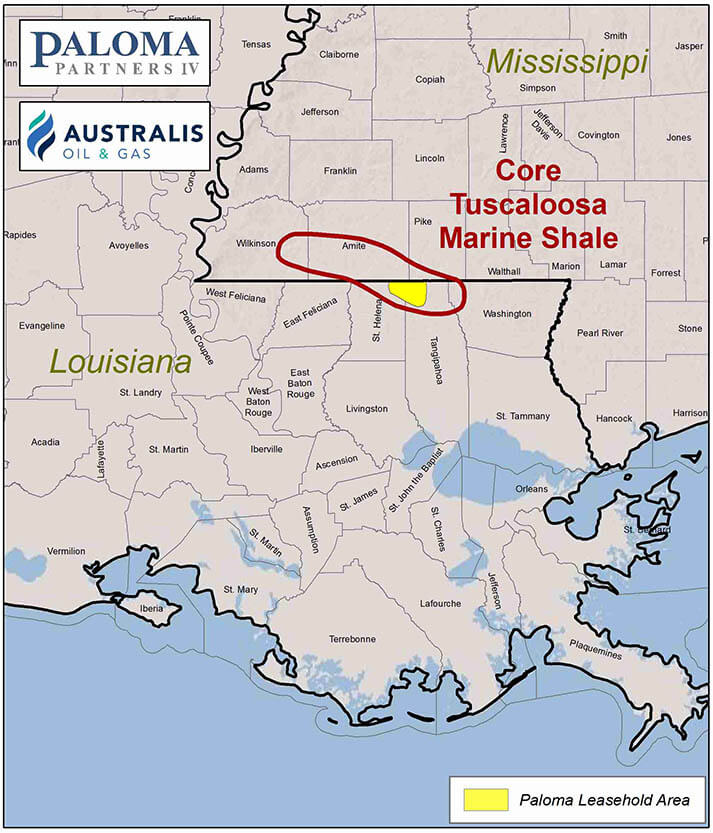

That map is the very place I found out about Australis. Paloma is hounding us to renegotiate terms of the extention on our lease. They have dropped the bonus $ and extended the time frame from 3 years to 5. Now they are wanting to scale back the acreage but still extend the lease to 5 years. Every thing i have seen with Paloma's history they on keep interest in any play no longer than 2 years max. When i pulled the website up showing Australis it looked like they would be the new owners of the Paloma's position in the play.

Needless to say the negotiation will be on going until they come to OUR terms.

Any thoughts?

-

Permalink Reply by Skip Peel - Mineral Consultant on February 3, 2016 at 4:49

Permalink Reply by Skip Peel - Mineral Consultant on February 3, 2016 at 4:49 -

My thought is, the chances of the TMS becoming economical to develop in the next couple of years appear to be slim and none. Beyond that, who knows. Even with technology advancements and reduced field service costs it is probably no better than a 50/50 chance that the TMS will ever be economic. The ability of U.S. operators to quickly ramp up production in their shale rock tiers will cap the price of crude for many years, if not decades. The price may never rise enough to make the TMS a viable play.

-

Permalink Reply by Jennifer on February 3, 2016 at 5:01

Permalink Reply by Jennifer on February 3, 2016 at 5:01 -

Skip- thanks for the reply. Our family has never thought of great riches from this situation, it has been more of a fun hobby learning a little about the oil industry. I guess that is why our attitude about the negotiation for the lease is if it works out great but if not oh well. :-)

-

Permalink Reply by Skip Peel - Mineral Consultant on February 3, 2016 at 5:09

Permalink Reply by Skip Peel - Mineral Consultant on February 3, 2016 at 5:09 -

Jennifer, that's a good attitude to take. Without detail as to your specific mineral interest it's impossible for anyone with experience to advise you how far to go with your demands for lease terms. I'm suggesting moderate lease terms as opposed to attempting to push the envelope. The length of the lease term shouldn't be a prime consideration under the circumstances. The standard beneficial and protective lease clauses should remain a requirement.

Support GoHaynesvilleShale.com

Top Content

Groups

-

WESTERN HAYNESVILLE

17 members

-

Natchitoches Parish

405 members

-

Bienville Parish, LA

249 members

-

SMACKOVER LITHIUM GROUP …

10 members

-

SONRIS Help Center

255 members

-

Sabine Parish, LA

456 members

-

Evangeline Parish

17 members

-

SMACKOVER LITHIUM GROUP …

8 members

-

North LA Cotton Valley C…

67 members

-

Webster Parish

301 members

Blog Posts

Tuscaloosa Trend Sits On Top Of Poorest Neighbourhood For Decades - Yet No Royalties Ever Paid To The Community -- Why??

In researching the decades-old Tuscaloosa Trend and the immense wealth it has generated for many, I find it deeply troubling that this resource-rich formation runs directly beneath one of the poorest communities in North Baton Rouge—near…

ContinuePosted by Char on May 29, 2025 at 14:42 — 4 Comments

Not a member? Get our email.

© 2026 Created by Keith Mauck (Site Publisher).

Powered by

![]()

| h2 | h2 | h2 |

|---|---|---|

AboutAs exciting as this is, we know that we have a responsibility to do this thing correctly. After all, we want the farm to remain a place where the family can gather for another 80 years and beyond. This site was born out of these desires. Before we started this site, googling "shale' brought up little information. Certainly nothing that was useful as we negotiated a lease. Read More |

Links |

Copyright © 2017 GoHaynesvilleShale.com