Michael Fitzsimmons believes the Natural Gas Glut is over. Do you?

http://seekingalpha.com/article/1947681-the-natural-gas-supply-glut...

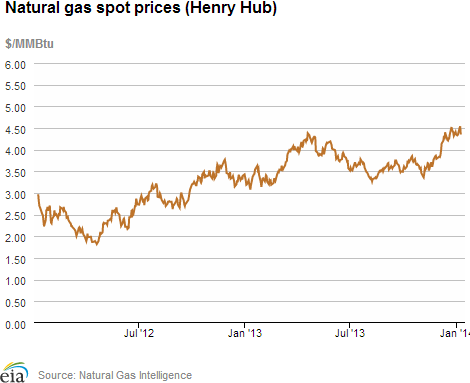

Last week the Energy Information Administration ("EIA") released its weekly natural gas storage report. In my opinion the report established what spot prices have been telling us: the natural gas supply glut is over. While this is bullish and certainly a welcome development for Exxon Mobil (XOM), the #1 producer of natural gas in the US, smaller companies like Cabot Oil & Gas (COG), Chesapeake Energy (CHK) andConocoPhillips (COP) derive a much larger percentage of revenues from domestic natural gas and will therefore see a larger impact on profits.

The sharp increase in natural gas spot prices has been widely reported. More interesting to me is the gas in storage versus the historical 5 year range - the blue line within the gray zone of the chart below. This line is clearly at the low end of the range, and indeed is on the verge of moving outside the range. Although gas in storage was on the low-end of the five-year range throughout much of 2013, it certainly did not start out the year that way. In January of 2013, just as in January of 2012, gas in storage started off the year at the very high end of the five-year range, not the low end, or possibly even below the low-end.

Tags:

Replies to This Discussion

-

Permalink Reply by ledlights on January 17, 2014 at 11:02

Permalink Reply by ledlights on January 17, 2014 at 11:02 -

Although flared/vented gas seems like a criminal waste to me, it is not at all clear how one can account for any future effect it may have on supply. My impression about the flared gas in the Bakken is it is due to lack of current infrastructure to handle it and there is no real requirement to build such infrastructure - it's just lost potential revenue and a lot of green house gas. I have no information about the rate at which that lack may be diminishing. Seems like there is far more concentration on finding ways to keep up (which they are having a hard enough time doing) with the more lucrative oil and liquids currently. Don't you have to compare the relative profit of liquids and oil to that from gas before you can estimate at what gas price the incentive is great enough to spend much more on gas handling infrastructure?

Given the depletion curves on shale gas, can we assume that there will be anywhere near as much (no longer flared) gas that will be added to our supplies when the Bakken infrastructure can fully handle it? Is the Bakken still on the growth side of development so we can just assume a growing amount of gas being produced from wells and no matter how much has been flared there will still be a huge increase in the amount available to produce when/IF Bakken gas infrastructure starts to catch up?

-

Permalink Reply by jim weyland on January 17, 2014 at 12:52

-

until gas takeaway infrastructure was in place, were i the "state", i'd require the associated rich gas to be carried to field common points. and, there have it run through j-t plants to increase present day liquifiables severance tax revenues. i'd also/then require gas reinjection into the production horizon. note: the j-t liquids could be commingled w/the oil for transport.

i don't have access to industry publications anymore, so i'm just guessing there's a passel of mid-stream boys and girls busting their guts to tie-in all of the now flared wells to new build gathering systems to central processing plants and to further new build pls for transport of tailgate gas to now existing gas trunklines.

it's certainly in their interests to do so. after all, there's nothing like triple dipping fee income from a "captive" producer to warm a pipeliner's heart. and, besides, it's in the state's interest, too.

-

Permalink Reply by ledlights on January 20, 2014 at 9:29

Permalink Reply by ledlights on January 20, 2014 at 9:29 -

Mike,

Notice the silence following your post. I suspect folks here have largely lost all interest in providing any attention for Mr. Berman. Though it will be interesting to see how this great money losing conspiracy plays out. Who would have thought that energy producers would be so interested in losing money?

I suspect that projections about near term gas prices should probably take what is happening in the Marcellus into account. Another Seeking Alpha article - concerning how Marcellus production continues to outstrip all predictions:

http://seekingalpha.com/article/1949421-marcellus-shale-a-20-bcf-pe...

-

Permalink Reply by Skip Peel - Mineral Consultant on January 20, 2014 at 10:55

Permalink Reply by Skip Peel - Mineral Consultant on January 20, 2014 at 10:55 -

And the vast area of prospective Marcellus Shale will take some years to HBP. Which is just more production flowing into a glutted market. Mike, ledlights is right. Many of us have Berman fatigue.

-

Permalink Reply by Eli on January 21, 2014 at 17:04

Permalink Reply by Eli on January 21, 2014 at 17:04 -

While I would love for Nat Gas to get up in the $5 - $6 range, the sad fact is there is too much production that could come on line quickly ( over a 6 month period) and glut the market again, and the other and most important limiting factor that keeps a solid lid on Nat Gas is the many power company's that can switch generators fuel source from Nat Gas to Coal, and do go back to Coal if gas gets much over $3.50

Several years ago, Obama's EPA mandate appeared ready to shut down a large number of coal burning power plants in 2013, however, elections were coming and he had EPA stand down and leave them alone for the time being. If the EPA mandated Coal plant emission restrictions, which was upheld by the Courts, is allowed to be implemented, then all bets are off as to the holding back Nat Gas prices.

I don't wish our Country or our power plants ill, but the EPA enforcement would be the only real way to get much improved Nat Gas pricing, and get it to be more on par with Oil on a btu content basis

-

Permalink Reply by Skip Peel - Mineral Consultant on January 21, 2014 at 17:42

Permalink Reply by Skip Peel - Mineral Consultant on January 21, 2014 at 17:42 -

I'd been thinking that the future industrial demand in the Lower Mississippi Industrial Corridor and the Gulf Coast would largely bolster Haynesville production in that same time frame. Now I'm not so sure. GTL projects seem to be viewed less favorably by those that think that crude will go lower. One project has already been cancelled. There is also a new pipeline connecting that area to the Marcellus. Marcellus gas may displace some Haynesville production owing to price differentials. I think that the market for natural gas liquids may improve but I suspect that the new demand will not lift Haynesville prices appreciably.

-

Permalink Reply by tc on January 22, 2014 at 3:18

-

In an outside the box thinking, this cold winter could in the end hurt NG prices and especially the Haynesville. The cold weather is causing a propane shortage and a price spike. Propane is usually a major component of "wet gas", so it could be even more profitable to drill in those areas with wet gas i.e. Eagle Ford & Marcellus, which will in turn add more dry gas to the supply chain.

-

Permalink Reply by Steve on January 22, 2014 at 5:41

-

Contrary opinion: Gas prices to stay in the $4-$5 range for next 20 years?

http://www.bizjournals.com/dallas/news/2014/01/17/report-natural-ga...

-

Permalink Reply by Skip Peel - Mineral Consultant on January 22, 2014 at 5:47

Permalink Reply by Skip Peel - Mineral Consultant on January 22, 2014 at 5:47 -

Double post alert! LOL!

-

Permalink Reply by Steve on January 22, 2014 at 5:51

-

Check out the edit. My fingers are too large for the keyboard

-

Permalink Reply by Skip Peel - Mineral Consultant on January 22, 2014 at 5:53

Permalink Reply by Skip Peel - Mineral Consultant on January 22, 2014 at 5:53 -

Just click the x in the upper right corner of your reply and delete one.

- ‹ Previous

- 1

- 2

- 3

- 4

- Next ›

Support GoHaynesvilleShale.com

Top Content

Groups

-

WESTERN HAYNESVILLE

17 members

-

Natchitoches Parish

405 members

-

Bienville Parish, LA

249 members

-

SMACKOVER LITHIUM GROUP …

10 members

-

SONRIS Help Center

255 members

-

Sabine Parish, LA

456 members

-

Evangeline Parish

17 members

-

SMACKOVER LITHIUM GROUP …

8 members

-

North LA Cotton Valley C…

67 members

-

Webster Parish

301 members

Blog Posts

Tuscaloosa Trend Sits On Top Of Poorest Neighbourhood For Decades - Yet No Royalties Ever Paid To The Community -- Why??

In researching the decades-old Tuscaloosa Trend and the immense wealth it has generated for many, I find it deeply troubling that this resource-rich formation runs directly beneath one of the poorest communities in North Baton Rouge—near…

ContinuePosted by Char on May 29, 2025 at 14:42 — 4 Comments

Not a member? Get our email.

© 2026 Created by Keith Mauck (Site Publisher).

Powered by

![]()

| h2 | h2 | h2 |

|---|---|---|

AboutAs exciting as this is, we know that we have a responsibility to do this thing correctly. After all, we want the farm to remain a place where the family can gather for another 80 years and beyond. This site was born out of these desires. Before we started this site, googling "shale' brought up little information. Certainly nothing that was useful as we negotiated a lease. Read More |

Links |

Copyright © 2017 GoHaynesvilleShale.com