Very little new natural gas storage capacity has been built along the Gulf Coast the past few years, but that’s changing. Driven by rising demand from power generators, LNG operators/offtakers, marketers and traders for storage with high deliverability rates — and by improving storage economics — new salt-cavern and depleted-reservoir capacity is now being developed by midstream players large and small, with plans for a lot more. In today’s RBN blog, we‘ll continue our review of gas storage projects in Texas, Louisiana and Mississippi with a look at what Kinder Morgan, EnLink Midstream and Enstor Gas have been up to.

As we discussed in Part 1, a combination of factors — among them, rising gas production, increasingly undulating demand for gas (tied in part to the ups and downs of wind and solar power), frequent extreme weather events, new LNG export capacity, and plans for tens of thousands of megawatts (MW) of new gas-fired power generation — have been increasing the value of Gulf Coast gas storage or, more specifically, the merit of quickly injecting and withdrawing gas to respond to market swings. There’s a caveat though: While gas storage capacity is increasingly valued for its role in providing volume assurance and the opportunities created by high deliverability, that doesn’t necessarily mean storage values will be high enough to support the large-scale buildout of new facilities. Instead, the development of new storage capacity is likely to be very targeted — it will happen only where it clearly makes economic sense.

Last time, we looked at the big chunk of Gulf Coast gas storage assets in Louisiana and Mississippi that midstream giant Williams acquired earlier this year from Hartree Partners for $1.95 billion — six facilities with a combined capacity of 115 Bcf — as well as recent comments from Williams suggesting that rising storage rates and interest in storage capacity may soon justify the development of new brownfield (and possibly greenfield) projects. We also looked at Enbridge’s more than 100 Bcf of Gulf Coast salt-cavern storage — including its 35-Bcf Tres Palacio and 22-Bcf Moss Bluff salt cavern facilities in Texas and its 29-Bcf Bobcat and 21-Bcf Egan sites in Louisiana — and the favorable environmental assessment it received from federal regulators in May for a planned 6.5-Bcf expansion at Tres Palacios. Today, we turn our attention to three other companies with existing storage and plans for more.

Kinder Morgan

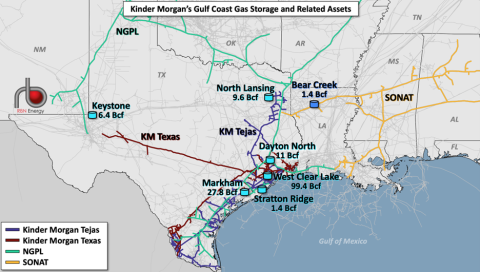

Kinder Morgan is a big dog in gas storage, not just along the Gulf Coast but nationally, with full or partial ownership in more than 700 Bcf of storage capacity, including more than 155 Bcf (light-blue tank icons in Figure 1 below) along or near the midstream giant’s Texas and Tejas intrastate pipeline systems (brown and purple lines): 99.4 Bcf of capacity at West Clear Lake, 27.8 Bcf of capacity at its recently expanded Markham Storage facility in Matagorda County (more on that in a moment), 11 Bcf at Dayton North, 1.4 Bcf at Stratton Ridge and (if you include West Texas) 6.4 Bcf at Keystone. Kinder also has 1.4 Bcf of storage (Bear Creek) in northern Louisiana along the Southern Natural Gas (SONAT) system (medium-blue tank icon and yellow lines, respectively), in which it holds a 50% stake.

Figure 1. Kinder Morgan Gulf Coast Gas Storage and Related Assets. Source: RBN

Join Backstage Pass to Read Full Article